The Federal Reserve’s approach to interest rates is evolving as the economic landscape shifts. With a dovish outlook emerging, the implications for highly leveraged companies and overall market performance are significant.

Impact of Rising Interest Rates on Highly Leveraged Companies

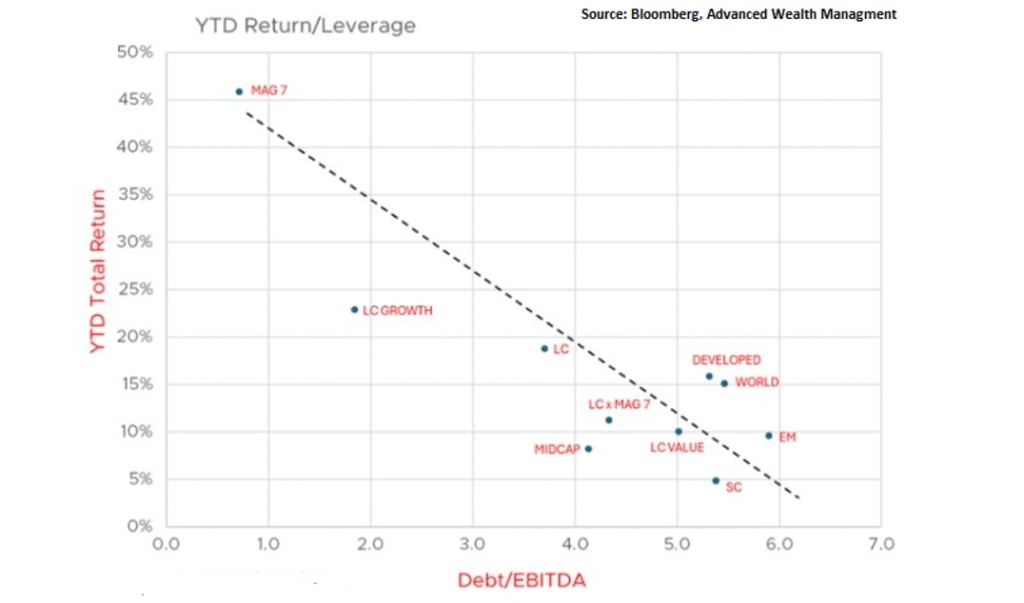

Highly leveraged companies have faced considerable challenges due to the rapid increase in interest rates over the past two years. Since March 2022, the Fed has raised its benchmark rate by 5.25 percentage points to combat inflation, which has led to increased borrowing costs for these firms. As a result, many have struggled to maintain profitability amid rising expenses and tighter financial conditions.

The anticipated easing of interest rates could serve as a crucial catalyst for these companies, potentially improving their earnings and performance. As borrowing costs decrease, firms may find it easier to service their debts, invest in growth, and enhance shareholder value.

Highly leveraged companies have struggled under rising interest rates:

which have severely affected their financial stability and operational capacity Here are the key reasons why these companies are facing challenges:

Increased Cost of Debt

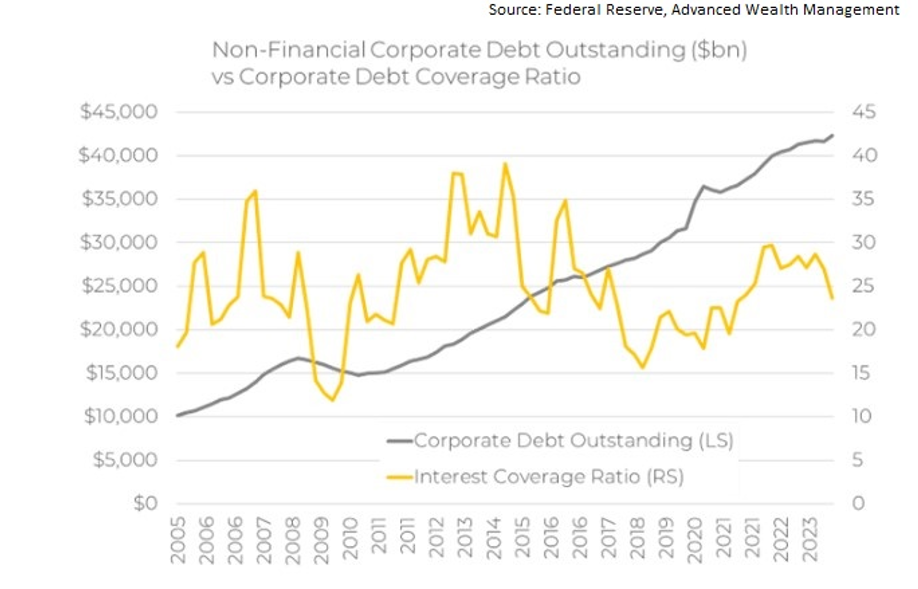

As interest rates have risen, the cost of servicing existing debt has escalated for highly leveraged firms. Many companies that relied on low borrowing costs to finance their operations and growth are now grappling with higher interest payments, which can strain cash flow and reduce liquidity. For instance, mid-market companies have seen debt-to-EBITDA ratios exceed 5.5x, a historically high level, making it increasingly difficult to manage their debt burdens as rates rise.

Risk of Default

With rising rates, the risk of default has increased, particularly for firms with low interest coverage ratios. Companies that have taken on significant debt may find that their interest payments exceed their earnings, leading to potential insolvency. In Asia, for example, a notable percentage of corporate debt is concentrated in firms with interest coverage ratios below one, indicating a heightened risk of default as borrowing costs climb.

Decline in Investment Activity

Higher interest rates have also led to a slowdown in investment activities, particularly in leveraged buyouts, which rely heavily on debt financing. The number of buyout investments has declined, limiting opportunities for investors and affecting the overall market for leveraged transactions. This shift is problematic for private equity firms that traditionally depended on leverage to drive returns.

Shift in Investment Strategies

The current environment forces investors and companies to reconsider their reliance on financial engineering to generate returns. Instead, there is a growing emphasis on revenue growth and operational improvements as key drivers of performance in a high-rate environment. This strategic shift reflects the need to adapt to a landscape where low-cost debt is no longer a given.

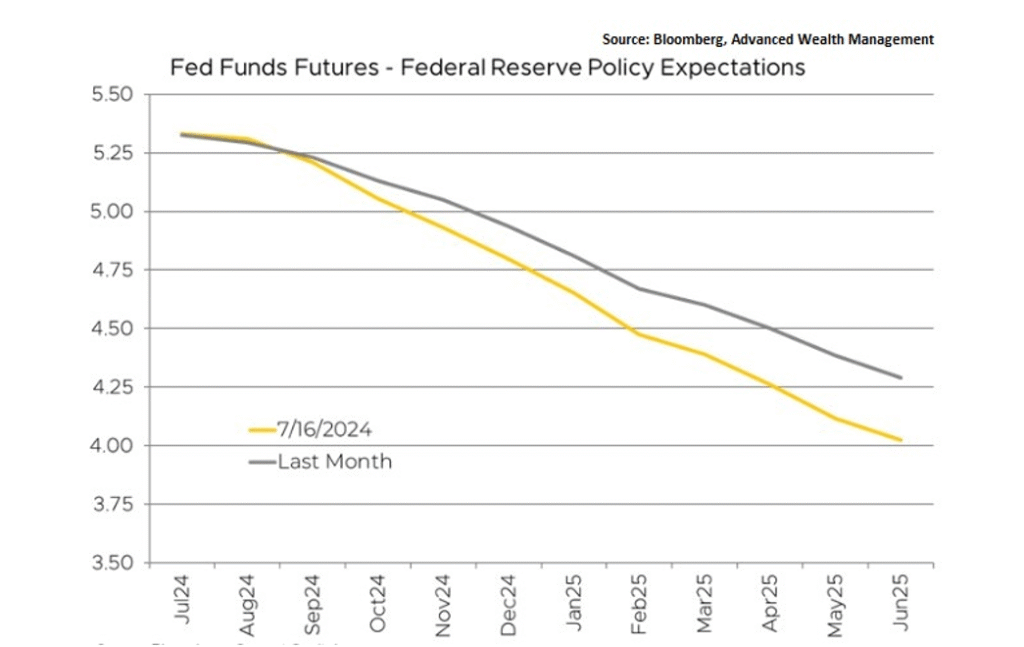

Interest Rate Outlook is Increasingly Dovish

Recent signals from the Fed suggest a shift towards a more dovish monetary policy. Analysts expect that the Fed may begin to cut rates in the near future, driven by easing inflation and a stable labor market. This dovish outlook is crucial for highly leveraged companies, as it indicates a potential reprieve from the financial pressures they have faced due to rising rates. The Fed’s approach aims to balance economic growth with inflation control, and a more accommodative stance could provide the necessary support for struggling firms. As the economic environment stabilizes, companies may find it easier to refinance existing debts and reduce their overall cost of capital

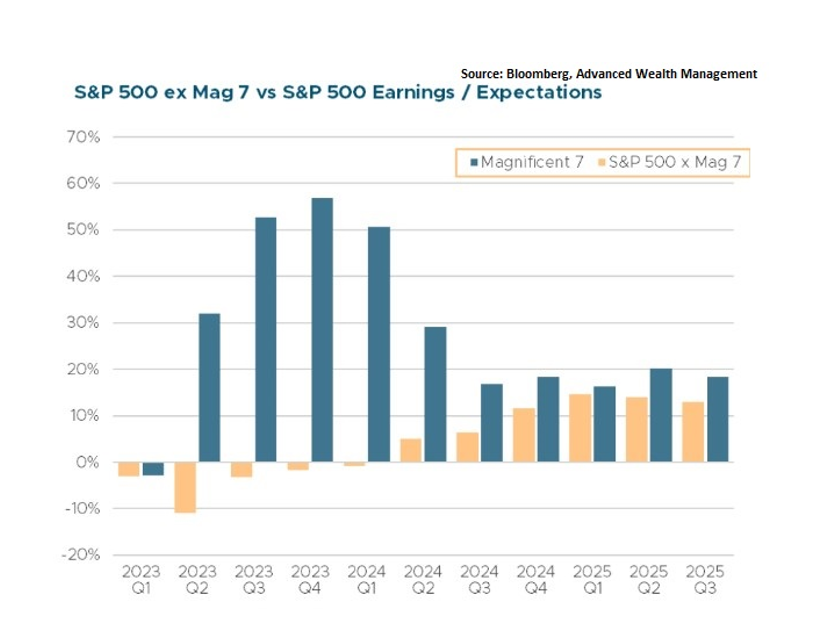

Easing Borrowing Costs as a Catch-Up Catalyst for Earnings and Performance

The anticipated easing of borrowing costs is expected to act as a catch-up catalyst for earnings and overall performance among highly leveraged companies. Lower interest rates will reduce the cost of servicing debt, allowing firms to redirect funds towards growth initiatives, operational improvements, and investment in technology. This shift could enhance profitability and improve cash flow, which are critical for companies that have been struggling under high debt burdens.

Moreover, easing rates may stimulate broader economic activity, leading to increased consumer spending and investment. This economic boost could further support corporate earnings, helping firms recover from the challenges posed by higher rates. The expectation of rate cuts has already begun to influence market sentiment, with projections indicating a potential 12% growth in earnings per share for the S&P 500 over the next year, contingent on favorable economic conditions.

Conclusion

In summary, the combination of easing borrowing costs and a dovish interest rate outlook presents a crucial opportunity for highly leveraged companies to recover from the adverse effects of rising rates. As the Fed navigates its monetary policy, these firms must remain vigilant and adaptable, leveraging the potential for lower rates to enhance their financial stability and drive future growth.

The Value of Holistic Wealth Management: At Advanced Wealth Management (AWM), we are dedicated to integrating personalized retirement planning, goal-based planning, and investment management with proactive tax, estate, and insurance planning. Our Boutique Family Office™ integrated service model addresses each client’s unique needs and objectives comprehensively. By staying current with financial regulations, economic trends, and market dynamics, we empower our clients to make informed decisions that enhance their financial well-being and secure their futures.

At AWM, our Fiduciary Duty Principles™ embody our commitment to transparency and integrity, ensuring you receive advice that aligns with your goals, not ours. This commitment sets us apart in a field where true fiduciaries are rare.

Knowledge is Power! Understanding the intricacies of the economy, markets, and broader financial policies is crucial—not just for staying informed but for taking control of your financial future. Knowledge equips you with the tools necessary to make strategic decisions, optimize your financial outcomes, and achieve financial freedom aligned with your life goals.

How Can We Help You? At AWM, we deliver proactive, comprehensive, and compassionate advice to individuals, organizations, and families. Our personalized solutions are tailored to meet each client’s unique needs, providing security and peace of mind.

Investment Management Explore our customized, globally diversified, tax-efficient investment portfolios designed to align with your financial plan and endure over time. Our Intelligent Allocation® technology dynamically adjusts to meet clients’ evolving needs in a fluctuating market environment.

Proactive Tax Planning and Management Explore innovative tax strategies designed to help you defer, reduce, and better manage your tax liabilities, with a focus on retirement and distribution phase planning.

Integrated Goals-Based Planning Incorporate all aspects of your life into a unified financial plan to navigate the optimal path to achieving your goals through any life event or transition.

Healthcare and Long-Term Care Planning Prepare for the future with comprehensive healthcare and long-term care planning that ensures you and your loved ones are well taken care of.

Social Security Optimization Maximize your Social Security benefits with our expert optimization strategies.

Estate & Legacy Planning Secure your legacy and ensure your estate is managed according to your wishes with our comprehensive services. We maintain strategic relationships with attorneys across 49 states.

First Step: Schedule Your Free Second Opinion Service Call Contact AWM today to schedule a confidential consultation and get matched with an advisor who can help you achieve your financial dreams.

Need Further Help? If you have any questions or need further assistance, please reach out to us at Service@awmfl.com.

Thank you for your continued trust and engagement.

Tony Gomes, Author, MBA

CEO and Founder

Advanced Wealth Management

Content Disclosure: The information provided here is general and educational and not a substitute for professional advice. It has been prepared solely for informational and educational purposes and does not constitute an offer or recommendation to buy or sell any particular security or to adopt any specific investment strategy. While we believe the information shared is accurate and reliable, we do not guarantee its completeness or precision. The insights may include forecasts, opinions, and discussions about economic conditions, market scenarios, or investment strategies, which are subject to change.