As April comes to a close, markets face one of the most pivotal weeks of the year. Investors are closely watching both corporate earnings and crucial labor market data that could shape the outlook for the months ahead.

Several of the market’s biggest names—Apple, Amazon, Microsoft, and Meta Platforms—are scheduled to report earnings this week. With markets looking for signs of resilience amid global economic uncertainty, these results carry extra weight. Meanwhile, Friday’s April jobs report is expected to offer fresh insight into the health of the U.S. labor market. Analysts are forecasting a gain of 130,000 jobs, down from March’s surprisingly strong 228,000. Early indicators, like job openings and layoffs, suggest the first signs of tariff-related slowdowns and possible government cutbacks.

The broader earnings calendar is also busy. Coca-Cola, Pfizer, Honeywell, and General Motors report early in the week, with more than 100 S&P 500 companies following. Consumer-facing firms may provide important clues about spending patterns after another dip in consumer sentiment reported by the University of Michigan.

Despite a strong finish last week, U.S. stocks remain down roughly 10% from their February highs. A late-week rally was attributed to more conciliatory comments regarding tariffs and a dovish shift among Federal Reserve policymakers. As the Fed enters its quiet period before next week’s meeting, markets have largely ruled out a May rate cut but are pricing higher odds for June.

Internationally, the Bank of Japan is expected to hold rates steady, while Chinese manufacturing data could show further contraction—adding to the complex backdrop facing global investors.

Although most S&P 500 companies are beating profit expectations, many are issuing conservative outlooks, citing cost pressures, supply chain challenges, and softening demand. This cautious tone echoes across industries, including technology, consumer goods, and airlines. Congress returns to session this week, with tariff concerns likely to be a central topic after heavy lobbying from the business community.

First-quarter earnings growth for the S&P 500 is now projected at 10.1%, up from initial estimates of 7.2%. However, revenue growth remains modest, reflecting that much of the earnings strength is being driven by cost-cutting rather than robust demand.

Adding to the challenges, middle-income households report growing financial stress, and inflation expectations have surged to their highest levels since 1981. Bond markets have responded, with Treasury yields falling, reflecting both economic uncertainty and expectations of potential Fed action later this year.

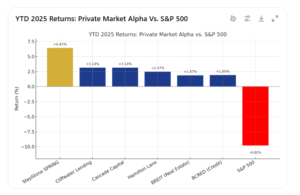

Beyond Traditional Markets: Private Market Alpha™ Shows Strength

While public markets struggle with volatility, Advanced Wealth Management’s Private Market Alpha™ (PMA) strategy continues to deliver stable, positive returns. Year-to-date through March 31, 2025, PMA strategies have significantly outperformed public benchmarks:

📈 YTD 2025 Returns:

StepStone SPRING (Venture & Growth Equity): +6.43%

Cliffwater Enhanced Lending (Private Credit): +3.14%

Cascade Private Capital (Diversified Private Capital): +3.14%

Hamilton Lane (Diversified Private Equity): +2.47%

BREIT (Blackstone Real Estate Income Trust): +1.87%

BCRED (Blackstone Private Credit Fund): +1.90%

S&P 500: -9.8%

These results reinforce the purpose of the Private Market Alpha™ strategy within your portfolio—to minimize downside risk, provide consistent income, and enhance long-term total returns.

In contrast to public markets, many of these investments are less susceptible to short-term volatility due to limited redemption structures and valuations based on real operating results and capital activity.

✅ Key Advantages of Private Market Alpha™:

-

Non-correlation to public markets

-

Tax-efficient income

-

Access to top-tier private managers like Blackstone, Hamilton Lane, StepStone, and Cliffwater

-

Consistent returns even during periods of public market drawdowns

Diversification beyond traditional markets is no longer just a preference—it’s essential. The PMA strategy provides non-correlated returns, tax-efficient income, and access to top-tier private managers like Blackstone, Hamilton Lane, StepStone, and Cliffwater. Furthermore, because private investments are less exposed to daily market swings, they offer a powerful buffer during public market downturns.

Conclusion:

At Advanced Wealth Management, we believe that a resilient financial plan requires flexibility, diversification, and access to opportunities traditionally reserved for institutional investors. As markets face uncertainty in 2025, our commitment remains the same: helping you navigate volatility with confidence. If you would like to review your portfolio’s private market allocations—or explore how Private Market Alpha™ could enhance your overall strategy—please reach out. Together, we can ensure your plan remains strong, adaptive, and forward-looking.

Book a complimentary portfolio review with our team today – Book Now

Download our latest investment playbook here – Click Here

At AWM, Our Fiduciary Duty Principles™ Define Our Commitment

Our Fiduciary Duty Principles™ reflect our dedication to transparency, ensuring that your goals remain our priority. Knowledge equips you with the tools to make strategic decisions and optimize financial outcomes.

How We Can Help You

At AWM, we provide personalized, comprehensive guidance for individuals and families. Our services offer peace of mind and confidence through every stage of your financial journey:

- Investment Management: Our globally diversified, tax-efficient portfolios are designed for resilience across market conditions.

- Proactive Tax Planning: We focus on tax-efficient strategies for both accumulation and distribution phases, helping you manage liabilities.

- Integrated Goals-Based Planning: Align all life goals into a unified financial plan to navigate transitions strategically.

Contact AWM today to schedule a confidential consultation and connect with an advisor who can help you achieve your financial goals. For assistance, reach out to us at Service@awmfl.com.

Thank you for your continued trust and engagement.

Tony Gomes, Author, MBA

CEO and Founder

Advanced Wealth Management

Content Disclosure: The information here is general and educational. It is not a substitute for professional advice and does not constitute a recommendation. Forecasts and opinions are subject to change.