As the next U.S. presidential election looms, there’s no shortage of speculation about its impact on financial markets. Many investors are left wondering: Should I change my investment strategy based on the election results?

While the temptation to react is strong, history suggests that adjusting your portfolio based on short-term political outcomes can lead to costly mistakes. In this article, we’ll break down how elections really affect markets, examine the historical data, and show why staying the course is often the smartest move.

Do Elections Really Impact the Markets?

Every four years, as election day approaches, financial news is filled with predictions about how the stock market will react depending on which candidate wins. Many investors fall into the trap of thinking they can predict the market’s response and adjust their investments accordingly. However, historical data shows that this strategy is rarely successful.

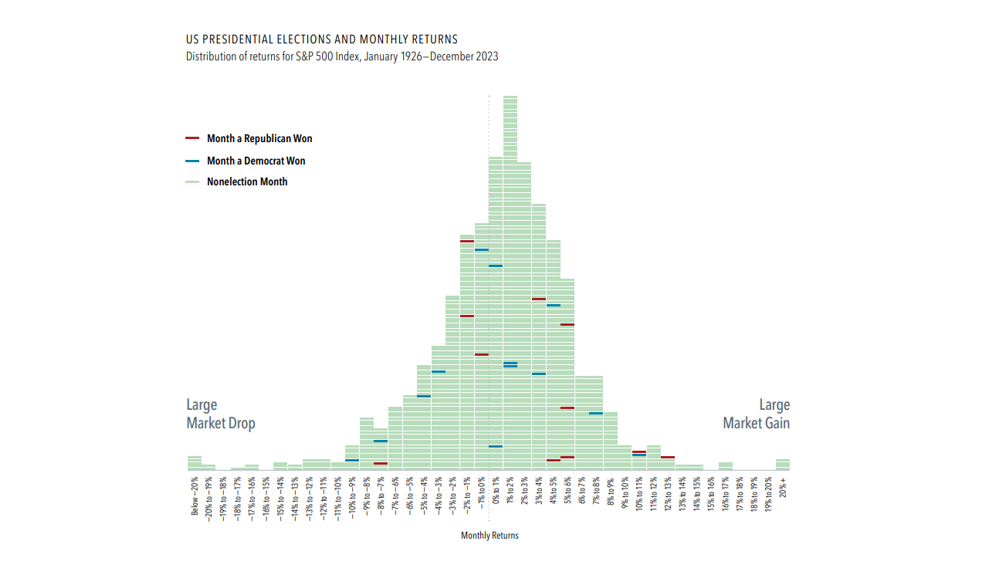

From 1926 to 2023, the stock market’s performance during presidential election months has not shown any consistent pattern. Whether it’s a Republican or a Democrat winning the White House, the market tends to behave in a way that is largely independent of political outcomes.

This chart illustrates that returns in election months are usually within a modest range—most commonly between 0% and 2%. Despite common fears of drastic market movements, these election months don’t tend to produce extreme volatility. So, while the media might suggest markets are on the edge of a cliff every four years, the data suggests otherwise.

Does the Winning Party Really Matter?

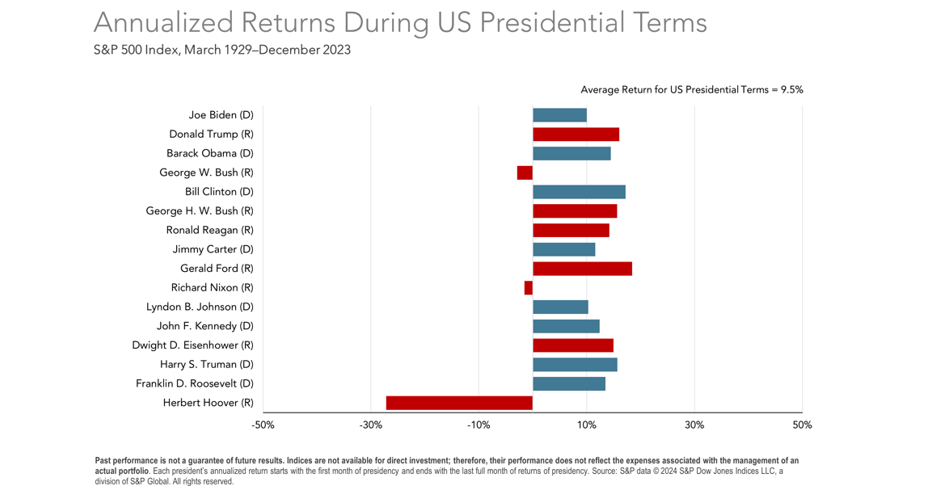

It’s a common belief that one political party may be better for the stock market than the other. Many assume that markets perform better under Republican leadership, while others think Democratic policies drive economic growth. But when we look at the data, it tells a different story.

The truth is that no matter who wins the presidency, the stock market shows no clear preference. Market performance during months when Democrats won has been similar to months when Republicans won.

Stick to Your Long-Term Strategy

One of the most important lessons from history is that sticking to a long-term investment plan beats short-term reactions. While elections can cause temporary market volatility, they don’t alter the long-term trajectory of the stock market. In fact, the market tends to stabilize after any initial post-election jitters.

Let’s take an example: Investors who panicked during the 2016 election when Donald Trump won and sold their stocks missed out on significant market gains in the following months. This is just one instance where reacting to political events resulted in missed opportunities.

Instead of trying to predict market movements based on who wins the presidency, focus on your long-term goals. A well-diversified portfolio and a solid investment strategy will always serve you better than making emotional, reactionary moves.

Historical Data: What the Numbers Say

Here’s what the numbers tell us:

- 1926 to 2023 data shows that election months don’t display a consistent pattern of extreme gains or losses.

- The S&P 500 Index has produced varied returns, and these returns are spread across a broad range. No clear trends emerge to suggest a reliable link between the party in power and market performance.

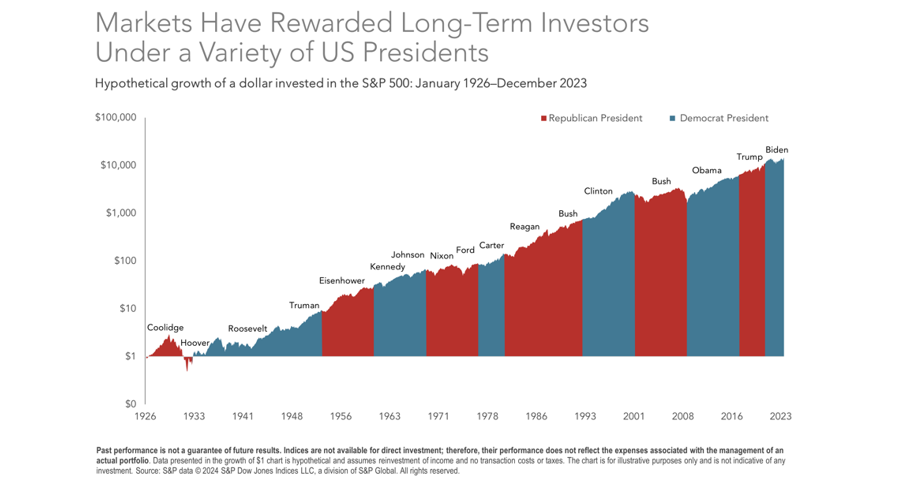

- If you had invested $1 during the 1920s and kept it invested, your dollar would have grown to about $4,000 by today. This long-term upward trend demonstrates the power of staying invested through various political cycles and economic changes.

This historical perspective shows that the market’s long-term growth doesn’t depend on the political party in power. The market tends to rise despite short-term political events, and investors who hold on through election cycles generally see better results.

This historical data proves one key point: it’s not about who wins the election, it’s about staying the course. Long-term investors who avoid trying to time the market based on political outcomes are often the ones who see the best returns.

The Dangers of Reacting to Short-Term Events

It’s natural to feel nervous during election seasons, especially with media outlets amplifying potential market risks. But reacting to short-term events like elections often leads to emotional decision-making, which rarely pays off.

For example, some investors might sell their stocks if they believe a certain candidate’s policies will hurt the economy. Others may jump into industries they think will benefit from a new administration. These speculative moves can lead to losses when the market doesn’t behave as expected. Instead of reacting emotionally, remember that markets are incredibly efficient. By the time election results are in, the market has already priced in most of the political uncertainty. Therefore, trying to outguess the market based on election outcomes is a gamble you’re likely to lose.

Focus on What You Can Control

So, what should you do during an election year? The best course of action is to focus on what you can control—your investment plan. A well-diversified portfolio that aligns with your risk tolerance and long-term goals is key to weathering any market storm.

Rebalancing your portfolio periodically, especially if election-related volatility has shifted your asset allocation, can help ensure you stay on track. It’s also helpful to consult with a financial advisor who can provide a steady hand during uncertain times.

David Booth, co-founder of Dimensional Fund Advisors, put it simply: “Vote with your ballot, not your life savings.” Instead of trying to guess which candidate will be better for the market, focus on maintaining a diversified portfolio and sticking with your long-term plan.

The Bottom Line

Presidential elections are undeniably important, but when it comes to your investments, reacting to political outcomes is rarely a wise move. History shows that the stock market’s long-term growth doesn’t hinge on who holds office, but on the performance of the businesses within it.

Investors who stick to a disciplined, long-term strategy tend to fare better than those who try to time the market based on political events. So, as we head into the next election cycle, remember to stay focused on your financial goals, diversify your investments, and avoid making knee-jerk decisions based on short-term political drama.

FAQs:

- Should I change my investments based on who wins the election?

No, history shows that reacting to election outcomes often leads to emotional decisions and poor results. Stick to your long-term investment strategy. - Do markets favour one political party over the other?

No, the stock market has historically trended upward regardless of which party is in power. - What should I focus on during election season?

Focus on your long-term financial goals, ensure your portfolio is diversified, and avoid making hasty decisions based on political events. - Is market volatility normal during elections?

Yes, it’s common to see some volatility around elections, but markets generally stabilize in the long run. - The Value of Holistic Wealth Management: At Advanced Wealth Management (AWM), we are dedicated to integrating personalized retirement planning, goal-based planning, and investment management with proactive tax, estate, and insurance planning. Our Boutique Family Office™ integrated service model addresses each client’s unique needs and objectives comprehensively. By staying current with financial regulations, economic trends, and market dynamics, we empower our clients to make informed decisions that enhance their financial well-being and secure their futures

At AWM, our Fiduciary Duty Principles™ embody our commitment to transparency and integrity, ensuring you receive advice that aligns with your goals, not ours. This commitment sets us apart in a field where true fiduciaries are rare.

Knowledge is Power! Understanding the intricacies of the economy, markets, and broader financial policies is crucial—not just for staying informed but for taking control of your financial future. Knowledge equips you with the tools necessary to make strategic decisions, optimize your financial outcomes, and achieve financial freedom aligned with your life goals.

How Can We Help You? At AWM, we deliver proactive, comprehensive, and compassionate advice to individuals, organizations, and families. Our personalized solutions are tailored to meet each client’s unique needs, providing security and peace of mind.

Investment Management Explore our customized, globally diversified, tax-efficient investment portfolios designed to align with your financial plan and endure over time. Our Intelligent Allocation® technology dynamically adjusts to meet clients’ evolving needs in a fluctuating market environment.

Proactive Tax Planning and Management Explore innovative tax strategies designed to help you defer, reduce, and better manage your tax liabilities, with a focus on retirement and distribution phase planning.

Integrated Goals-Based Planning Incorporate all aspects of your life into a unified financial plan to navigate the optimal path to achieving your goals through any life event or transition.

Healthcare and Long-Term Care Planning Prepare for the future with comprehensive healthcare and long-term care planning that ensures you and your loved ones are well taken care of.

Social Security Optimization Maximize your Social Security benefits with our expert optimization strategies.

Estate & Legacy Planning Secure your legacy and ensure your estate is managed according to your wishes with our comprehensive services. We maintain strategic relationships with attorneys across 49 states.

First Step: Schedule Your Free Second Opinion Service Call Contact AWM today to schedule a confidential consultation and get matched with an advisor who can help you achieve your financial dreams.

Need Further Help? If you have any questions or need further assistance, please reach out to us at Service@awmfl.com.

Thank you for your continued trust and engagement.

Tony Gomes, Author, MBA

CEO and Founder

Advanced Wealth Management

Content Disclosure: The information provided here is general and educational and not a substitute for professional advice. It has been prepared solely for informational and educational purposes and does not constitute an offer or recommendation to buy or sell any particular security or to adopt any specific investment strategy. While we believe the information shared is accurate and reliable, we do not guarantee its completeness or precision. The insights may include forecasts, opinions, and discussions about economic conditions, market scenarios, or investment strategies, which are subject to change.