Introduction

The public market is shrinking. It’s time to take a look at adding Private Market Alpha to your portfolio.

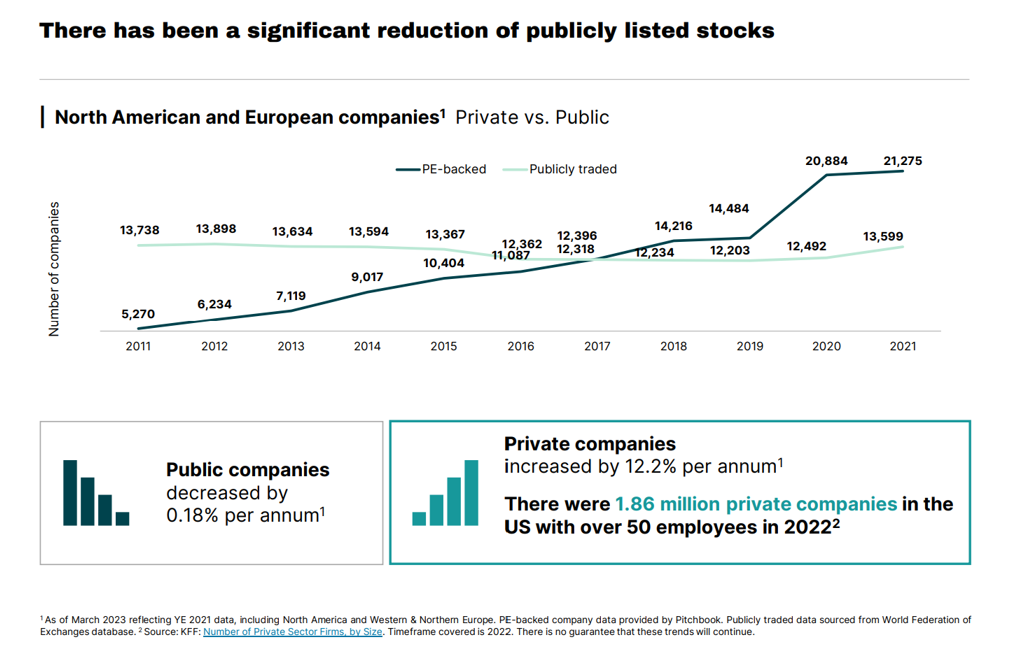

The Wilshire 5000 Stock Index, despite its name, currently comprises approximately 3,500 stocks. This discrepancy arises from significant changes in the number of publicly traded companies over the past fifteen years. Fifteen years ago, there were about 7,500 publicly traded companies in the United States, particularly on the New York Stock Exchange, NASDAQ, and other exchanges. However, the reduction in the number of stocks is primarily due to mergers and acquisitions (M&A), where two companies merge into one larger entity, and privatization, where publicly traded shares are acquired by large investment firms, effectively removing these companies from public trading.

The Rise of Private Market Alpha Investments

This has been happening to such a big degree over the past 15 years that while there used to be 7,500 companies publicly traded, nowadays it’s about 3,500. So Wilshire 5,000, which used to have the 5,000 largest companies in its index, doesn’t even have 5,000 stocks to count anymore.

What does this mean for you as an investor? Well, diversification becomes more challenging. The more investments you own, the lower your overall risks, right? I mean, any one company might go broke at any one time, but if you own a hundred companies, a thousand companies, well, the odds of them all going broke at the same time are a whole lot less than any one of them going broke at the same time. So we love the notion of diversification. The problem is, there isn’t as much opportunity for diversification in the stock market as there used to be, because we now have about half as many stocks today as we had 15 years ago.

Public vs. Private Markets: A Shift in Investment Strategy

In the old days, a company decided to go public, to make its shares available to ordinary investors because the company was trying to raise capital. They needed the money to grow their business. That isn’t what happens anymore. Today, companies go public not because they need to raise capital but because they want to monetize themselves.

In other words, if you look at Amazon, which went public decades ago, it was a very cheap stock because the company wasn’t very big. They needed the money to grow. But today, if a company needs cash, they don’t have to become public to get their cash. All they got to do is sell some of their company to a private equity business. The private equity investor will give them the capital they need and the company remains private.

Private Market Alpha Investments: Examples and Opportunities

By the time companies decide to sell their shares on the open marketplace, they are not trying to raise capital anymore—they are trying to cash out. Look at what happened with Facebook when they decided to go public. They were already a multi-billion dollar business. They were simply trying to cash in on their investment success rather than trying to raise capital to grow. This means for you, as a retail investor, trying to make an investment in the stock market, by the time you get to buy the stock, the company’s profits have already been obtained. They’re already a hugely successful business.

There are not only fewer stocks available for you to buy, but there’s also not as many of them you’d want to buy, simply because of the way they’re going public. So, what does it all mean for you? Well, it means you need to pay attention, not just to publicly traded stocks, but privately traded ones as well. This is where Private Market Alpha (PMA) investments come into play.

BREIT (Blackstone Real Estate Income Trust):

- Focuses on real estate investments and has delivered strong long-term returns since its inception in 2017.

- Portfolio includes real estate investments and real estate debt investments with a $59B net asset value (NAV) and a $113B total asset value.

- Performance as of March 31, 2024, indicates a 10.8% return since inception and a 4.7% annualized distribution rate.

BCRED (Blackstone Private Credit):

- Provides access to floating-rate, senior secured loans to large, performing companies.

- Emphasizes capital protection and aims to provide high current income.

- Key metrics include a 10.4% ITD total return and a 10.3% annualized distribution rate, with a 14.5% return in 2023.

Apollo Approach (Private Equity Solutions by Apollo Global Management):

- Apollo Private Equity Funds have delivered a net internal rate of return (IRR) of 22% since inception.

- Focuses on value orientation and capital preservation with flexible mandates across transaction types, industries, and geographies.

CNL Strategic Capital:

- Offers private investment opportunities aimed at long-term growth and monthly income.

- Focuses on providing capital to private companies with a risk-mitigated approach.

- Class I shares have shown an average annual return of 12.8% since inception.

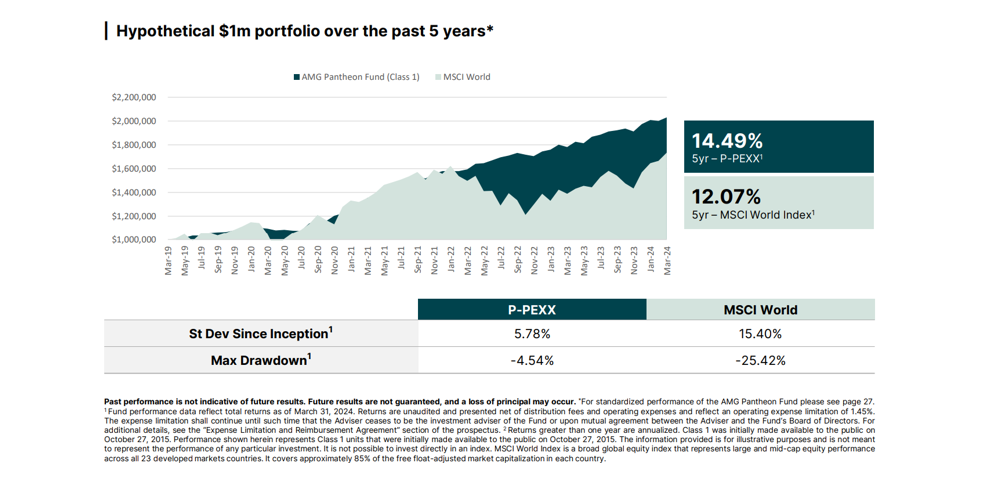

AMG Pantheon Fund:

- Provides Accredited Investors exposure to a diversified private equity portfolio sourced by Pantheon’s Global Investment Team.

- Offers diversification by manager, stage, geography, vintage year, and industry through a single allocation.

- Portfolio includes co-investments, secondaries, and primaries with a focus on delivering steady returns.

The Future of Private Market Alpha Investments

Private equity funds now own $8 trillion worth of companies, twice as much as just six years ago. Clearly, we need to be paying attention to this. Investing in private equity is generally available only to accredited investors. In other words, you’ve got to have a net worth of a million dollars or more or annual income of $200,000 or more to be able to buy these investments. That excludes an awful lot of people. Second, when you do make an investment in a private equity fund, that investment is going to be 7-10 years in duration. You are going to have a lack of liquidity during this period, creating a big investment risk.

There are, however, a couple of ways ordinary retail investors who aren’t accredited investors can invest in private equity. You can invest in the companies themselves. Some private equity companies are traded publicly, so you can actually invest in the PE company itself rather than in the funds that it’s raising money for. There’s also a movement to allow these PE investments inside 401k plans, making them accessible to more investors.

Conclusion: Diversify Your Portfolio with Private Market Alpha Investments

My point is this: if you like the idea of owning stocks, you need to look at the opportunity for owning a broader array of stocks than you can get merely through the public markets. The rise of private market alpha investments like BREIT, BCRED, Apollo, CNL Strategic Capital, and AMG Pantheon Fund provide unique opportunities for diversification and growth. By understanding and leveraging these options, you can better navigate the complexities of today’s investment landscape and build a more resilient portfolio.

FAQs

Q: Why are there fewer publicly traded stocks today?

A: The decline is primarily due to mergers and acquisitions, and companies being bought by private equity firms, which then make the companies private.

Q: What are private market alpha investments?

A: These are investments in private equity funds, which include strategies like buyouts, venture capital, and private credit, offering diversification and potential for higher returns.

Q: How can retail investors access private equity?

A: Retail investors can invest in publicly traded private equity companies or through 401k plans that offer private equity investment options.

Q: What are the risks of investing in private equity?

A: Private equity investments can be illiquid, involve high fees, and typically have long investment durations. They are also generally available only to accredited investors.

Content Disclosure:

The information provided here is general in nature and has been prepared solely for informational and educational purposes. It does not constitute an offer or recommendation to buy or sell any particular security or to adopt any specific investment strategy. It is not a substitute for professional accounting, legal, tax, insurance, or investment advice. While we believe the information shared is accurate and reliable, we do not guarantee its completeness or precision. The insights may include forecasts, opinions, and discussions about economic conditions, market scenarios, or investment strategies, which are subject to change. There is no assurance these insights will prove accurate.

Disclaimer: This information is general and educational. It’s not a substitute for professional advice.